This week, the Federal Reserve Board announced another expansion to the Main Street Lending Program (the “Program”), which is intended to allow more small and medium-sized businesses to receive Program loans. The Program launch date has not yet been announced, but is expected soon. When the Program does launch, it will be open to U.S. businesses with either 15,000 or fewer employees or $5 billion or less in 2019 revenue, which were in good financial condition before the onset of the COVID-19 pandemic. Program applications will be accepted directly by participating lenders.

The most recent changes to the Program are:

- reducing the minimum loan amount to $250,000 for New and Priority Loan Facilities (the minimum for Expanded Loan Facilities remains $10 million);

- increasing the maximum loan limit (see details below);

- extending loan terms from four years to five years;

- deferring repayment of principal for an additional year, making principal repayable beginning in the third year (see details below); and

- using the Main Street Special Purpose Vehicle to purchase 95% of each Program loan, reducing the risk to participating lenders.

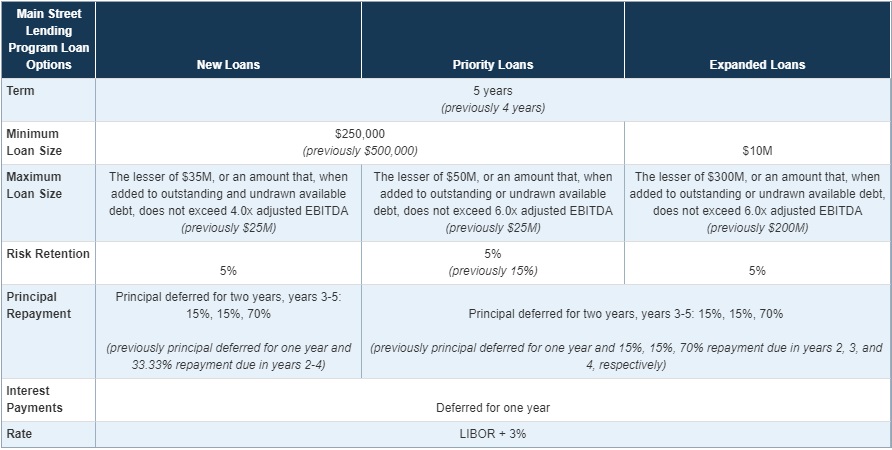

The maximum loan size now differs for each of the three Program options: New Loans, Priority Loans, and Expanded Loans. The maximum loan size for a New Loan is the lesser of $35 million or the amount that, in combination with the borrower’s outstanding and undrawn available debt, does not exceed 4x the borrower’s adjusted 2019 EBITDA. The maximum loan size for a Priority Loan is the lesser of $50 million or the amount that, in combination with the borrower’s outstanding and undrawn available debt, does not exceed 6x the borrower’s adjusted 2019 EBITDA. The maximum Expanded Loan size is the lesser of $300 million or the amount that, in combination with the borrower’s outstanding and undrawn available debt, does not exceed 6x the borrower’s adjusted 2019 EBITDA.

The Program revisions not only defer principal repayment, but they also stack most of the principal repayment obligations towards the end of loan terms. Principal repayment under all three types of loans will now be deferred for the first two years, and then 15% of the principal will be repaid at the end of year 3, 15% at the end of year 4, and 70% at the loan’s maturity date at the end of year 5.

Other portions of the Program—such as a one-year interest deferral, the use of a LIBOR + 3% interest rate, and the absence of loan forgiveness—remain unchanged.

Updated term sheets are available for each of the three Program loan types on the Federal Reserve website. The following chart published by the Federal Reserve also provides a helpful summary of Program terms.

Source: Federal Reserve Board

Source: Federal Reserve Board

The Federal Reserve of Boston (the “Boston Fed”), which will administer the Program, released updated Frequently Asked Questions about the Program. Standard lender and borrower forms are also available, but the versions currently posted here are in the process of being updated, so borrowers and lenders should wait and confirm that changes are complete before relying on the forms. Borrowers are also reminded that lenders will prepare the final loan applications, which will incorporate the standard terms released by the Boston Fed.

Please refer to our original post and our last update on the Program for additional details, visit the Program webpage, or contact us for more information.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

FOR MORE INFORMATION

For more information about the Main Street Lending Program, please contact your attorney at Gravel & Shea PC or any of the following attorneys at the firm:

Chip Mason (cmason@gravelshea.com), Cassandra LaRae-Perez (claraeperez@gravelshea.com), Oliver Goodenough (ogoodenough@gravelshea.com), Keith Roberts (kroberts@gravelshea.com), Pauline Law (plaw@gravelshea.com), or Catherine Burke (cburke@gravelshea.com).